Today businesses have the option to trade domestically and internationally with other countries. It would have been an absurd idea in the past, but technological advancement has brought the world closer. Cross Border E-Commerce has made it all possible.

E-Commerce is playing an important role in supporting global economic growth. As a result, governments worldwide consider E-Commerce as an engine for economic growth in the future.

The market volume is projected to be USD 1,542,511m in 2021, where China stands as a market leader, contributing a major chunk to revenue generation. It is predicted that E-Commerce users will amount to 1,223.9m by 2025. The user penetration will surge from 68.0% in 2021 to 83.5% by 2025.

The year 2021 has seen steady market growth, with key players adopting effective strategies; the market is all set to rise over the projected horizon.

This article will discuss the role of cross-border B2C E-commerce. It will guide you through the strategies adapted by giant tech companies to capture the market share. Also, you will have useful insights about the advantages of Cross Border E-commerce while discussing the market segments by type and region wise.

Cross Border B2C E-Commerce market in 2021

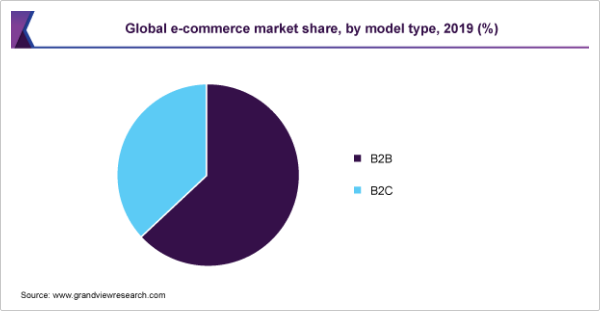

This pie chart shows the post-pandemic depiction of the market. Currently, the B2C market has taken over e-commerce, and it is the next big thing.

Globalization has created a hike in online sales of goods to customers internationally. This trend will be the main reason for the future growth of the cross-border B2C e-commerce market. Consumer behaviors have changed due to the pandemic so now companies are developing strategies to target potential customers in international marketplaces to increase sales.

The B2C global market size in 2020 was valued to be $ 3.67 trillion US dollars. It is predicted to expand with a growth rate of 9.7% from 2021 to 2028. Several factors attribute to the growth, such as

- Global per Capita Income

- Rising Disposable Income

- Easy availability of smartphones

- Growing Digital Dependency

- Online Shopping Convenience

Most B2C brands are focusing on the direct-to-consumer (D2C) channel to avoid unnecessary marketing costs. Studies show that around 50% of consumers utilized the D2C channel during the pandemic.

The use of cross-border e-commerce in business-to-consumer (B2C) is driving market growth globally. According to Zion Market Research, the Cross Border E-Commerce market will be worth US$4195.4 billion by 2027.

Top Players of Cross Border B2C E-Commerce

The prominent players have made unique business models to facilitate the sellers and consumers in online transactions. In addition, the leading retailers are merging with major players to complement their traditional selling with e-commerce platforms creating a smooth end-to-end shopping experience for customers with secure platforms, such as payment gateway.

The key players include BigCommerce, Jagged Peak, Amazon.com, eBay, Ali Express, AirBridgeCargo Airline, ASOS (As Seen On Screen), ACES, Flipkart Pvt. Ltd, Best Buy, Walmart Inc., Apple Inc., and JD.com.

The market is fragmented due to fierce competition now and in the future. To sustain their market presence in cross-border B2C e-commerce, all the players are testing and implementing various strategies. The premiere strategy is business expansion through acquisitions, mergers, and strategic partnerships to remain on top of the game.

Amazon, Alibaba, and Cross-Border E-Commerce

This section will take you through how the customer experience of Amazon became a standard for E-Commerce. It will also discuss how Alibaba helps revive global trade.

The Amazon Benchmark

Although Amazon.com did not initiate one-click shopping, fast shipping, and easy returns, and personalized recommendations, it did inculcate all of these to create a digital customer experience like no other. Amazon has set a benchmark for other competitors in terms of customer experience, which others are now being replicated to meet customers’ expectations.

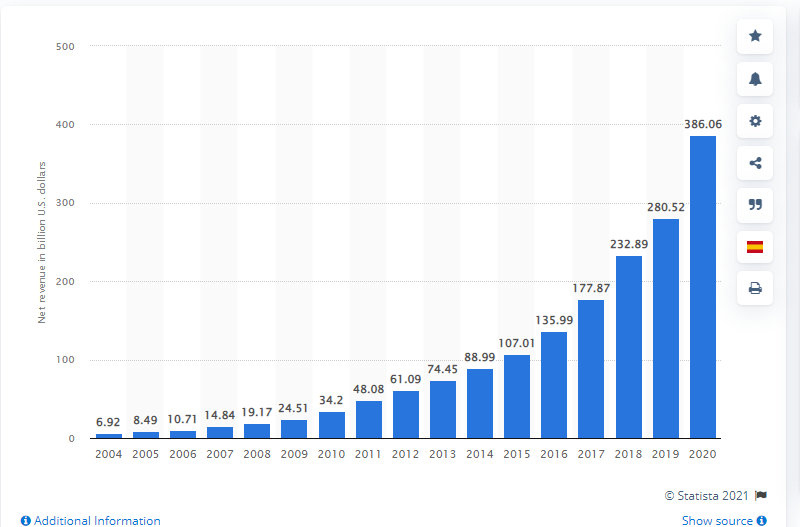

Even Alibaba, which is considered the biggest rival of Amazon cannot compete in terms of customer experience, which is evident from the figures. In 2019 Amazon had annual revenue of $233 billion as compared to Alibaba reporting $56 billion, which was not even a quarter of Amazon’s revenue.

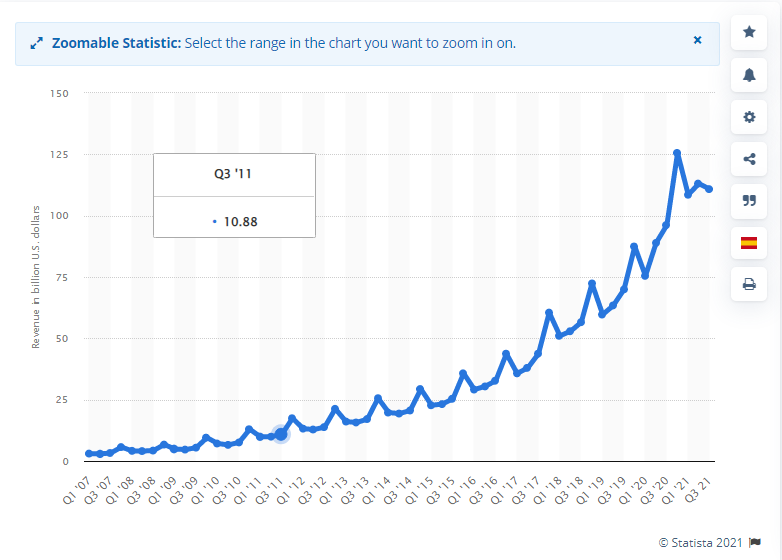

Amazon generated total net sales worth the US $110.81 billion in the third quarter this year compared to the US $96.15 billion in 2020. Net product sales have been the main reason behind this revenue surge.

Amazon Quarterly Net Revenue 2007-2021 (in billion U.S Dollars)

While Amazon has always been seen as a Cross Border E-Commerce platform, the business went through a massive transformation in 2019. The focus shifted to services which accounted for 43% of revenue, which was half in the previous years. Interestingly, Amazon Web Services, which are B2B cloud services, are driving Amazon’s profits rather than the assumed Amazon Prime and the E-Commerce platform.

Its Cloud Business made it a market leader amongst the highly competitive market for cloud infrastructure. As a result, Amazon has made a record profit consecutively in four quarters.

Amazon’s Annual Net Revenue 2004-2020 (in billion U.S Dollars)

To come at par with Amazon, the E-Commerce vendors at the cloud need to add as many elements as they can to their shopping sites aligned with Amazon’s customer experience. These vendors include BigCommerce, Salesforce, Adobe Magneto, Shopify, and Oracle, all trying to infuse SEO, shipping network, payment process to their platform.

According to Des Cahill, Oracle head CX evangelist, “Amazon has raised the benchmark for many western countries for end-to-end consumer experience” He goes on to explain that it is not only a B2C phenomenon but has come into B2B as well.

Significant Changes

- Fast, free shipping is the major change Amazon has modeled for all sellers. It has pushed online retailers to offer more. Amazon has taught other merchants how to get profit from this popular perk by shipping quicker, trying to ship free else including shipping costs into product costs.

- Personalized recommendations by Amazon enable ease of buying and provide personalization. Other online retailers and platforms need to create innovative data-driven solutions to compete this upsell.

- Start-up businesses have to go as per the expectations around e-commerce businesses shaped by Amazon. They have to create a business model covering free exchange and free shipping.

Alibaba

Alibaba Group Holding is a powerful platform for cross-border e-commerce, a tech giant specializing in e-commerce, retail, internet, and technology.

The pandemic created an opportunity for international brands to penetrate the Chinese economy. It was due to the online shift of the consumer. In addition, the rise in purchasing imported products from brands bonded warehouses or getting products delivered from warehouses in foreign countries operated by third-party companies gave a hike to cross-border shopping.

The number of online shoppers is expected to increase from 140 million in 2020 to 160 million by the year-end of 2021.

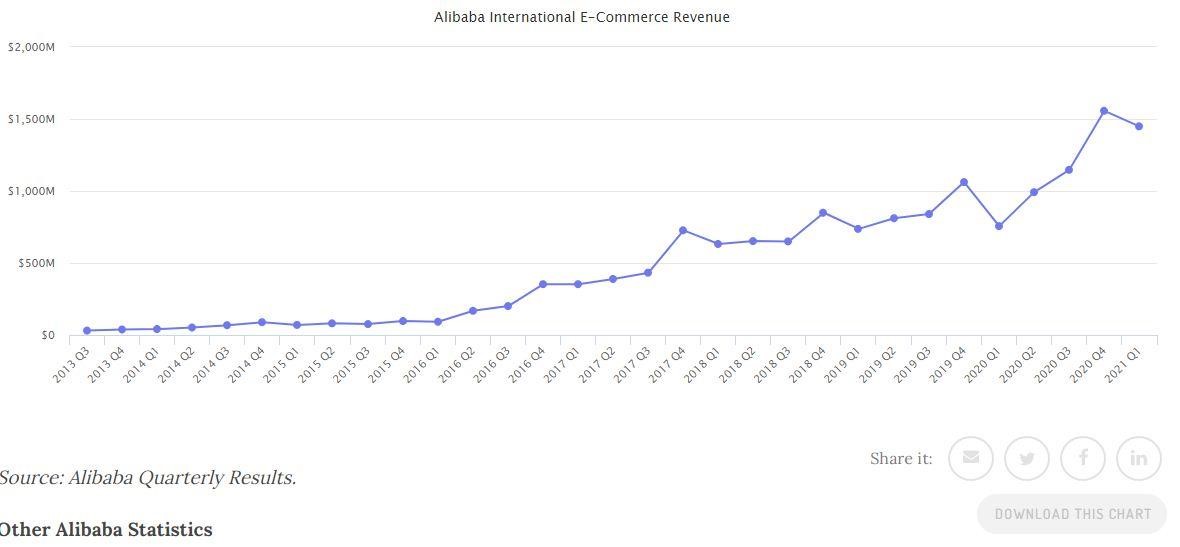

Alibaba Groups Tmall Global is the biggest cross-border e-commerce website in China. This platform facilitates brands to ship products, get customs clearance and store the products in a bonded warehouse. There has been a 60% increase in the brands and retailers using this channel. In addition, generation Z consumers and Chinese millennials shop on B2C marketplaces for foreign products.

Alibaba, through Tmall Global, is taking initiatives to create accessible cross-border e-commerce for small and medium-sized enterprises (SMEs). This platform gained popularity among small-medium enterprises and international brands looking for new revenue streams during COVID-19. As a result, more than 22,000 new brands and 200,000 stock-keeping units (SKUs) were listed on Tmall Global in 2020.

The revenue from international platforms, such as AliExpress for cross-border exports, Tmall Group for cross-border imports, and Lazada covering South East Asia Market surged up to $4,452 million in 2020, showing an increase of 29% from $3,450.00 million in 2019. While in the first quarter of 2021, it was up by 92% to USD1,449.00mn from $756.00 million.

Thousands of US retailers use Alibaba to grow and connect with Chinese consumers. The US merchants have sold products worth $54 billion directly to consumers in China through Alibaba platforms.

Capitalizing on Cross Border E-Commerce

Let’s look into some factors on how to take advantage of cross-border e-commerce for future growth?

According to E-Marketer, in 2022, one out of four US consumers is expected to buy something from a vendor outside the US. It will be as easy as physically buying something from a nearby store. This will be possible if the following steps are taken in the right direction.

- Identifying relevant regulations

- Securing the supply chain

- Analyzing digital storefront data

If a merchant wants to expand internationally, the priority should be catering to the needs of international buyers and accommodating their expectations. Once a business fulfills these requirements, success is guaranteed in foreign markets with skyrocketing revenues.

Advantages of Cross Border E-Commerce

- Cross-border e-commerce opens doors to opportunity. Following are the main advantages

- Makes business more sustainable

- Builds a lasting customer relationship

- Enhances access to the end customers

- Enables to sell products that have less demand in domestic markets to international markets

- Creates brand awareness

- Helps surge revenue

- Enables exploring profitable markets through international expansion

Market Segments of Global Cross-Border E-Commerce

The Cross border B2C E-commerce market is segmented into Platform, Category, Services, and Region.

Platform Overview

- Business-to-Business

- Business-to-Consumer

- Consumer-to-Consumer

Category Overview

- Food & Beverages

- Personal Care

- Furniture Products

- Consumer Appliances

- Smartphones & Allied Products

- Fashion & Apparel

- Others

Amongst all the categories, apparel and accessories hold the highest market share over the forecast period. The maximum usage of cross-border B2C e-commerce has contributed to the growth of this category.

The market is divided into sub-segments such as payment type, offering type, and organizational size.

Payment Type

- Credit/Debit cards

- Internet Banking

- Digital Wallets

Offering Type

- In-House Brands

- Assorted Brands

End-users Type

- Millennials

- Adults

- Senior Citizens

- And others.

Organizational Size

- Small & Medium Enterprise

- Large Enterprise

Countries Influencing Cross-Border E-commerce Market Investment

In Europe, the warehouse demand is pitching as Amazon and Alibaba eagerly take the warehouse space. Furthermore, the increase in warehouse demand has forced investors to pour in money for warehouse expansions due to a surge in online shopping in Europe.

New Zealand and China have upgraded their existing trade pact through an agreement. The new agreement will allow widened tariff-free schemes, faster processes for exporters, and expanded market access.

Region-Wise Insights

- The Asia Pacific strongly influenced the cross-border e-commerce market with 55.3%. It is predicted to experience the fastest growth from 2020-2027. The market growth of this region is due to B2B e-commerce platforms, developing infrastructure facilities, and increasing the number of internet users.

- Luxury goods and service providers are witnessing phenomenal growth in the Chinese market.

- North America has one of the highest internet penetration rates. Europe and North America are expecting steady growth over the forecast period.

- The Middle East, Africa, and Latin America have an increasingly young population and a fast-evolving online shopping market. These factors will contribute to future market growth.

The Way Forward

Nowadays, customers can purchase goods through borderless online markets. The cross-border e-commerce market offers unlimited opportunities to capitalize upon. The rapidly expanding online business-to-consumer (B2C) market has resulted in a paradigm shift in consumer behavior and forced retailers to create a seamless customer experience.

Retailers need to understand the consumers’ expectations and utilize e-commerce platforms for global reach and profitability.

E-Commerce giants like Amazon and Alibaba have set a bar for other e-commerce platforms. This article helps us understand the factors making them market leaders. It gives us a market watch of the revenues generated through cross-border e-commerce and how each market segment contributes to success. We also learn about the role of countries and the region-wise growth of the cross-border e-commerce market.

CATEGORY

1 on 1 Dedicated Managers

for Personalized Solutions as your very own dedicated in-house team

CUSTOMER CENTRIC

success for our customers at the heart of every action

Transparent & Trusted

clear cut processes trusted by 2000+ global sellers & brands

Amazon Seller Solutions Providers

servicing Amazon’s Global Sellers across Global Marketplaces