Paving the way for the future!

Many small and medium-sized enterprises in the U.K, U.S, and Australia fear expanding into the global marketplace through the conventional ways since cross-border e-commerce doesn’t offer SKU counts or larger catalog demands. However, recently newer technologies in e-commerce around the globe are expanding and emerging, slowly integrating into the undiscovered Asian markets and other developing countries. This has ensued in continuous streams of revenue from the e-commerce industry.

While businesses continue to expand, cross-border e-commerce strategies often set organizations apart from each other when it comes to profit-making – it comes with its own set of challenges.

We witness these challenges as a by-product of operations, shipping, logistics, changing customer experiences, and demographic changes. It’s evident that one e-commerce strategy that works in one corner of the world might not show the same results in a different country, and it would be wrong to assume it would.

Time after time, new and improved brands are climbing up the ladder and reaching the successful side of cross-border e-commerce – increased sales and international clients.

This increase is credited to the increasing number of people accessing the web. WeAreSocial, in 2019 conducted research that deduced that global internet penetration surpassed 50 percent in 2016 along with the criteria of the annual change rate – which was initially assumed to rise over the next 12 months.

The statistics are inevitable:

- Compared to 366 million (9%) internet users in January 2018, 2019 experienced a rise in internet users to 4.39 billion.

- Resulting in 1 million users every day, more than 11 new users join the internet per second.

- The expenses of global e-commerce have significantly increased by 14 percent yearly.

Cross Border Ecommerce: Risks and Challenges

Major Risks Affecting Cross Border E-Commerce

- Deception is possibly the biggest risk faced by merchants who permit cross-border purchases of their goods. Choosing a good payment platform that understands customer-buying attributes is key to fair trade.

- Shipping and reverse logistics are equally essential and can negatively influence brand image as perceived by customers. Uniform and safe logistics are crucial for a business that wants to expand and profit on cross-border e-commerce.

- Legal – local regulations and tax laws need to be studied thoroughly. If not followed, they have the potential to harm the business.

- The tangible transfer of goods across borders utilizing e-commerce is under constant threat regarding time, cost, and border regulations. The primary issues at the border are law-abiding in nature – processes, laws, policies, and procedures that impede the transport of goods. According to the World Economic Forum’s ‘Enabling Trade Report 2013,’ dropping procurement obstacles may boost e-commerce cross-border trade by an estimate of 60 to 80 percent.

- Tools to facilitate cross-border e-commerce are abundant. Trade Facilitation Agreement (TFA), World Trade Organization (WTO), and the WCO’s Revised Kyoto Convention (RKC) on the popularization and coordination of custom measures can achieve successful results. However, they need to be adapted and implemented by governments.

- Detailed border clearance policies are daunting for international trade, customers, and merchants, and they can become greater barriers to SMEs. The rising cost of fulfilling import requirements and tedious paperwork impedes the delivery process, thus a challenge for e-commerce trade. The brand image of merchants, especially for SMEs, is often at stake by custom laws, slowed logistics, or incompetent return processes – common in most countries. Retailers are mainly worried about completing deliveries – a significant part of customer interaction.

- In order for e-commerce to be productive, the cost linked with order fulfillment must be up to mark in the customer’s view. The Organization for Economic Co-operation and Development (OECD) has evaluated that custom obstacles can add almost 24 percent premium to the cost of goods sold.

- MNCs and governments are the key players in conventional cross-border trade. However, technology innovation has enabled even the smallest business or entrepreneur to act as a micro multinational identity that exports goods across borders. These micro-business practices are adding value to the conventional business models. From micro shipments to micropayments, they aid the logistics and procurement process.

- Governments are keen to control cross-border activities to eradicate deception, revenue outflow, IPR frauds, and other illegal activities. These government bodies are concerned and faced with rising challenges ensued by e-commerce. Among the many e-commerce, challenges are micro shipments and the integration of new players in the industry.

- Legal bodies should employ intelligence and risk-based targeting and selectivity. They should consult legal and experienced retailers to improve the targeting and identification of risky or legal shipments. Moreover, governments should implement a tax/duty model, such as the ‘vendor collection mode’ under discussion by the OECD. This will advance a collective account-based duty model, which is frequently used for local transactions.

Opportunities For Cross Border E-Commerce

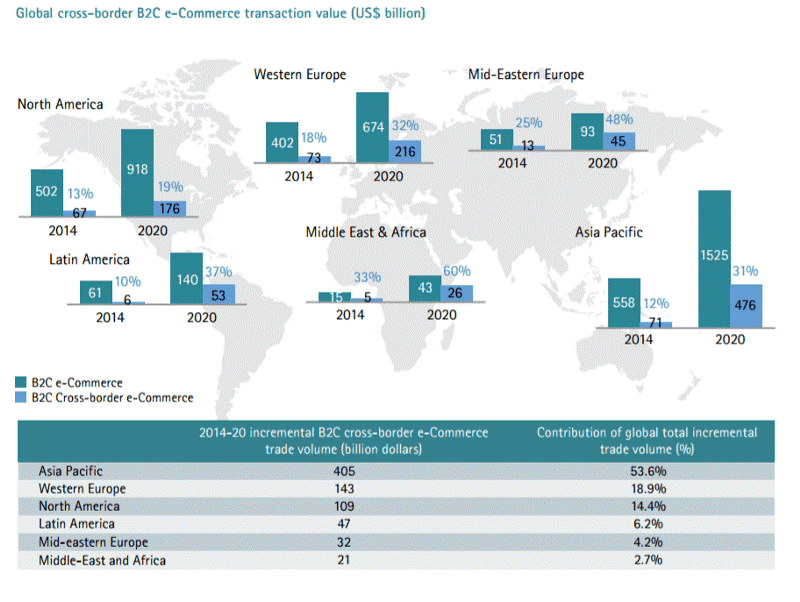

An estimated 2 billion e-shoppers or 60% of the global population, transacted 13.5% of their total retail consumption. The value equaled US$3.4 trillion as per Accenture.

China

Cross-border e-commerce in China is worth $60 billion, but legal implications may have an effect. Potential government interference is common in China since brands employ e-commerce to meddle with the policies of their products with local authorities. Cross-border e-commerce enables Chinese consumers to purchase international manufactured goods online and efficiently evade the regulations that have obstructed access to consumer products from Cognac to cosmetics and medicines. However, pressured with loss of revenue, and rising concerns from the conventional trader, the country is now seeking to reconsider the regulations.

Australia

Australians enjoy purchasing clothing from online retailers outside their country. The Chinese government, since March 2016, has issued a slew of regulations designed to expand regular tariffs on imports and compliance standards to foreign goods into China through cross-border e-commerce streams. The current leadership sparked outrage between many cross-border e-commerce merchants in China and across its borders. They put it on hold for an indefinite period, merely days before Premier Li’s March 2017 visit to New Zealand And Australia. Merchants hope that products sold into China through cross-border e-commerce will stand to profit from low taxes and legal exemptions.

Southeast Asia

According to reports, the Southeast Asian e-commerce market is expected to reach $200 billion by 2025, with online purchases growing at 32 percent CAGR. It is the world’s largest Internet user market, with 600 million shoppers and 260 million people on social media. Then, it makes sense that Alibaba and Amazon have accelerated their attention in the area.

Mexico

Due to the astounding rate at which the e-commerce market is growing, Mexico is potentially a long-term market with significant growth. Payment security concerns are impeding growth. Amazon has teamed up with a local supplier to allow customers to pay in cash for their purchases. The overall market has little competition, and at this growth rate, Mexico could become the key market in Latin American e-commerce in the long run.

France

Cross-border purchases are the fastest-growing e-commerce sector in France. Approximately half among all French consumers usually purchase from cross-border vendors, and 19 percent of all internet revenue in 2016 was made through international websites, four percent higher than the European average of 15 percent, with the U.K, Germany, the U.S, Belgium, and China being the most popular destinations. The main issue with French consumers is that their payments are small compared to the listed countries.

As discussed above, cross-border payments are tricky. They should have a management system that does not take the customers by surprise when the delivery reaches their doorstep. Comprehending the local regulations and tariffs is important to ensure that consumers pay accordingly. Otherwise, the delivery will return with added yet hidden costs and cause the business its reputation and revenue.

In essence, cross-border trade is here to last. It needs to be focused upon by merchants, customers, and essentially governments. It requires investment, research, personnel, equipment, logistics, and payment procedures.

Express Delivery Boosting Faster and Improved Cross Border E-Commerce

The Global Express Association represents four well-known express delivery companies, i.e., TNT, DHL Express, UPS, and FedEx Express, committed to working with Border checks and earnings officials as trustworthy collaborators to address e-commerce obstacles. They assist governments in the following ways:

- Advance digital consignments details – express shipping companies deliver digital order details ahead of shipment arrival so Border control can conduct risk evaluation and identify consignments for more evaluation;

- Risk assessment – delivery services undertake risk evaluation and validity of the information provided by the vendor based on credibility, including descriptions of unacceptable commodities as implied by the Border control.

- Tracking system – deliver companies allow parcels determined by border control as doubtful to be eradicated from the systems, permitting the Customs to examine the product.

- Facilitation – delivery service firms offer custom officers relevant facilities and tools to identify and study the shipment without any hurdle.

- Shippers and Consignees’ Information – these companies give Customs officers available information that may be lawfully revealed on the parcel’s packaging. They are aiding the officers in determining offending goods.

These, however, are concrete restrictions to what delivery companies can do. For starters, they are not initiators of the shipment information. There is certainly a restriction to the amount of information they can obtain from the customers. These companies are not law firms, as they too are subjected to national data protection and security rules. Customs is the relevant authority to implement laws, undertake risk evaluations, collect fines and taxes, and seize illegal goods.

Recommendations for Governments and Customs

The delivery service companies ensure that policymakers and liable distributors should collaborate to reduce barriers in business-to-consumer (B2C) e-commerce. Just competition among governmental and non – governmental delivery companies will lead to significant savings, improve service quality, and promote e-commerce growth.

Enabling customers to make their own shopping decisions enhances lifestyles and lowers expenses, and increases efficiency across the economy. In that ethos, the express delivery industry should make the following suggestions on how to handle e-commerce for it to live up to its potential:

- Implement risk assurance to address safety, revenue, security factors and consult assistance with delivery companies to improve product targeting.

- Apply the WCO Immediate Release Guidelines and relevant de minimis for all customers tariffs and duties.

- Just and fair treatment at the border to both private and public delivery service companies.

- Allow timely filing and payments through electronic cash, preferably through a single platform.

- Implement straightforward import/export registration and POA requirements.

- Introduce a simple and easy return shipment process.

- Implement pre-arrival processes and immediate clearance release.

- Employ simple regulations, including individual certification of the origin country

- Accept time-definite payment release

- 24/7 border clearance, when and where required by a business.

Conclusion

Cross-border e-commerce is undoubtedly an engine for growth in the coming years. With increased technology and advancements, many companies are now moving toward global e-commerce solutions that ease their logistics, operations, and interaction with customers effectively.

Countries accepting e-commerce as the next big thing invest, research, and implement to procure the multiple benefits of added revenue and imports to boost their economies. However, there is still a wider population hesitant toward accepting e-commerce as the perfect solution for cross-border transactions.

CATEGORY

1 on 1 Dedicated Managers

for Personalized Solutions as your very own dedicated in-house team

CUSTOMER CENTRIC

success for our customers at the heart of every action

Transparent & Trusted

clear cut processes trusted by 2000+ global sellers & brands

Amazon Seller Solutions Providers

servicing Amazon’s Global Sellers across Global Marketplaces